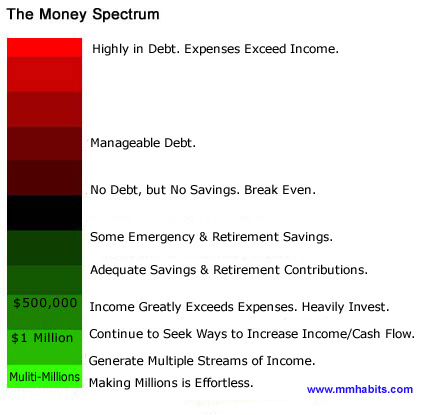

The Money Spectrum

I receive frequent inquiries from readers who visit this site who are all over the board in terms of where they are financially. Many people want to see more articles about getting out of debt and creating a budget. Others want to know how to accelerate their income and wealth accumulation.

This got me thinking about the stages people find themselves in financially. In most cases it is necessary to complete financial objectives in one stage before it is possible to move on to the next phase of the wealth accumulation process.

To illustrate this concept, I created The Money Spectrum. Obviously I’m not an artist, so please bear with the lackluster aesthetics.

If you examine the money spectrum, you will see that why the money game is not necessarily fair and how the rich get richer. While only 2% of Americans fall in the bright green categories, they own most of this country’s wealth. This makes sense though when you consider that most Americans are in the red and very little to no assets or net worth.

What I find interesting is the money spectrum highlights one of the key factors that financial advisers stress over and over. That is to get out of debt. The bright red area where expenses exceed income is where most people fall. Also notice that there are very few stages between the red zone and the green zone, which is where you start to build wealth. That’s because the income-to-expenses ratio is the only thing holding someone back from building wealth. You cannot move forward without taking control of expenses first.

On the flip side, once the debt-zone has been broken, the ability to make more money and increase wealth accelerates dramatically. Again, demonstrating why the rich get richer. Once you have money and have developed the proper habits of using money to make money, your ability to create wealth compounds at a very fast rate. You can see why millionaires often say that their first million dollars was the toughest.

Millionaire Money Habit: According to the money spectrum, an inability to manage debt and expenses makes it impossible to get ahead financially. Take a good look in the mirror and indicate where you are on the money spectrum. Make a commitment to do what it takes to move yourself into the next stage while keeping the bright green label as your ultimate, long term goal.

As you highlight in the article, the only way to make progress is to bring expenses under your income. And once you’re on the green side just a little bit the growth is exponential from there.

Great visual. Nice to see where I’m headed. Bright green baby!

Interesting that there’s not an easy slot for people with managable debt (mortgage, for example) AND emergency and retirement savings. I am in that class, and view working on other savings goals more important than paying down our low-interest mortgage early. According to your spectrum, though, that puts me very close to the red.

Great visual aid. Very helpful.

I guess the grass is greener on the other side. Ha. (bad joke).

Nice post and nice visual.

Hey KZ,

That’s a good point and glad you pointed that out. It’s not a perfect visual, but hopefully it help get the point across that it’s really tough to get to the bright green end of the spectrum without getting out of the red first.

Maybe when I referred to debt I should have been more clear that I was thinking more in lines of “bad debt” as apposed to “leveraged debt” that actually makes sense to have.

Ryan

Rule n.1 to achieve financial freedom: Get rid of the debt.

This is a fantastic article, well done! I have spent more than 10 years studying this topic because I am fascinated with it. 100% true that you have to manage your expenses in order to grow financially. In addition, I found that there are non-financial components that are essential in order to assist you with your financial growth. If you are interested you can click on my comment to visit my website which further explains my point. Well done again on the article and brilliant visual!

Best regards,

Christo

It is very interesting. Anyway, Personaly I think is very important the country where you live too. No all is America!

No matter if some one searches for his necessary thing, thus

he/she wishes to be available that in detail, therefore that thing is maintained over here.

I like the valuable information you provide in your articles.

I will bookmark your blog and check again here frequently.

I am quite certain I’ll learn lots of new stuff right here!

Good luck for the next!

I love the data on your web site. Cheers!

We have go through many great things below. Absolutely cost book-marking to get returning to. I’m wondering the best way a whole lot try out you set to build these kinds of excellent educational internet site.

Thanks for every other great post. Where else could anyone

get that type of info in such a perfect manner of writing?

I’ve a presentation subsequent week, and I am at the search

for such info.

If you would like to increase your knowledge simply keep visiting this site and be updated

with the most up-to-date information posted here.

Excellent blog right here! Additionally your site so much up fast!

What web host are you using? Can I get your affiliate hyperlink to your host?

I wish my site loaded up as quickly as yours lol

Wow, that’s what I was seeking for, what a data! present here at

this webpage, thanks admin of this site.

[…] The Money Spectrum Over the last two years, I’ve watched myself slide from one extreme end of this spectrum to somewhere approaching the other end. Nice. (@ millionaire money habits) […]

Nice blog! Is your theme custom made or did you download it from

somewhere? A theme like yours with a few simple tweeks would really make my blog jump out.

Please let me know where you got your theme. Kudos

I see you share interesting stuff here, you can earn some additional money, your website

has huge potential, for the monetizing method, just type in google - K2 advices how to

monetize a website

When someone writes an post he/she retains the thought of a

user in his/her brain that how a user can know it.

So that’s why this piece of writing is amazing.

Thanks!

Hello I am so happy I found your website, I really found you by mistake, while I

was browsing on Aol for something else, Regardless I am here now and would

just like to say many thanks for a fantastic post and a all round interesting blog (I also love the theme/design),

I don’t have time to read it all at the moment but I have

bookmarked it and also included your RSS feeds, so when I have time I will be

back to read much more, Please do keep up the excellent b.

Hi Your current website runs up seriously slow in my opinion, I not really know who’s issue is that but facebook starts up quite immediate.

Anyway, Thank you for publishing such a brilliant article.

I guess it really has been necessary to lots of people .

I must mention that you have done excellent work with this and additionally hope to find

further amazing stuff through you. I already have your site book-marked to look at blogs you publish.